We’ve faced a host of changes over the past few years—from how we live day-to-day, to our interactions with others, to how we plan for the future. Financial professionals and their plan sponsor clients (employers) told us what they see in the future of the retirement industry when it comes to saving and investment advice.

The Principal® Future of Retirement Survey asked financial professionals and employers how they see the retirement industry changing by 2030. 1(All statistics featured here are from this research unless noted.)

Get all these investment insights (PDF)

Top 5 challenges workers may face in retirement planning

The voices have been loud and clear. As it stands, the top emotion people feel when making financial decisions is “uncomfortable” (81%). 2 Saving for retirement is of the utmost importance—but when retirement is in sight and people need to make a plan, retirement uncertainty comes to a head.

The top five challenges workers will face in retirement planning, as reported by financial professionals and employers, were the same:

- Insufficient savings from workers

- Pre-retirees not engaging with retirement income planning

- Workers receiving advice and guidance too late

- Retirement income planning language too advanced for workers

- Retirees not prepared to handle multiple retirement income sources

But not all workers are in the same spot—in terms of their accumulated savings, investment options available on their workplace plan, nor their financial knowledge. The education we provide can help build a foundation of knowledge, but all deserve access to help if they want it—regardless of savings balance. With workers’ needs so varied, “help” can be a basic level of personalization to some, while others may need “advice” to feel comfortable with making decisions.

New retirement investment options will offer guidance and income

Plan providers and investment companies are coming up with new investment options and services to help meet workers’ changing needs. Many employers are looking for one silver bullet, but since workers needs are varied, more than one option—or a blended one—might be considered.

What do they see garnering more interest and changing the face of investment option lineups and services?

| Financial professionals | Employers | |

|---|---|---|

| A QDIA that’s a target date fund that transitions to a managed account | 76% | 86% |

| Guaranteed lifetime income standard on lineups | 82% | 68% |

| Managed account service | 74% | 78% |

| Personalized investment portfolios | 73% | 71% |

% = Significant differences noted

Looking ahead at retirement advice

More than three-fourths (76%) of workers would be interested in receiving help on which investments to choose, how much to save, and when to retire. 3 They also look to their employers for this help— “access to speak to a financial professional” comes in first as a requested feature of workplace retirement plans. 4

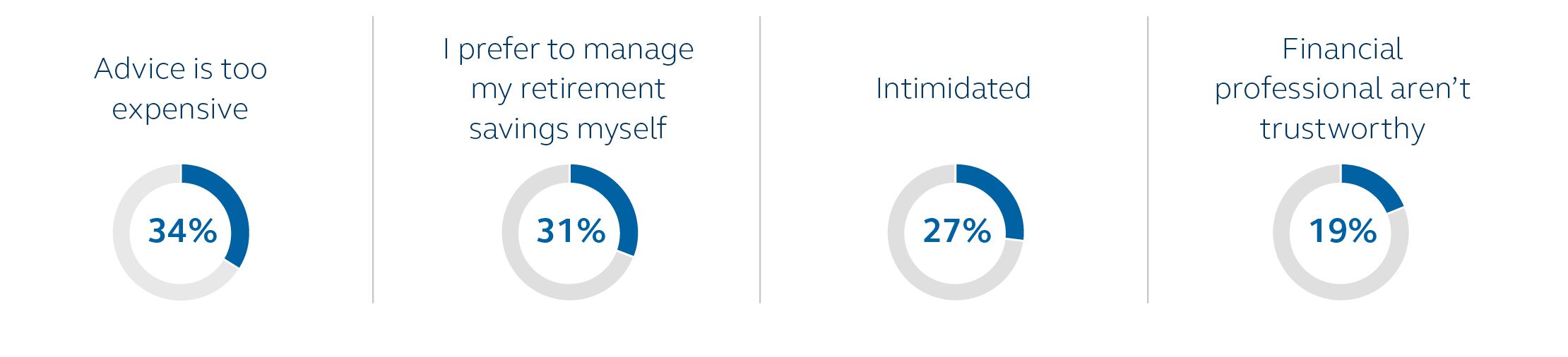

There’s solid desire for help—but why aren’t workers looking for advice now? Here’s what they say: 5

The convenience of working with a financial professional you know through your employer can have distinct benefits, but providing that level of service at scale would likely be challenging.

There’s a range of investment options that might help:

Retirement income planning and advice gaps

“Trust” is one reason why workers don’t engage a financial professional. But what does that mean? 6

| TOPIC | Financial professional self-rating | Worker rating of financial professionals |

|---|---|---|

| Skills in how to draw income | 91% | 73% |

| What to do with workplace account upon retirement | 89% | 48% |

| Making tax efficient withdrawal plans | 86% | 61% |

% = Significant differences noted

With retirement income planning being one of the biggest worker needs, these three topics should concern financial professionals. But these are perception problems providing opportunities for financial professionals to showcase their skills and prove themselves valuable in these areas. But with trust issues, feeling intimidated, and uncertainty about the process, many workers aren’t engaging with help.

Retirement advice: Setup workers for better outcomes

Workers have a wide range of needs, so it’s imperative to give them choices. We believe a financial professional is the gold-standard for providing advice. But that scale issue won’t go away on its own. Luckily, there’s a range of investment options available that can work at scale to help provide combinations of personalization—with many innovative likely to come.

See the Principal® Future of Retirement Survey

Learn more

Discover more retirement research and thought leadership insights.

About Target Date investment options:

Target date portfolios are managed toward a particular target date, or the approximate date the investor is expected to start withdrawing money from the portfolio. As each target date portfolio approaches its target date, the investment mix becomes more conservative by increasing exposure to generally more conservative investments and reducing exposure to typically more aggressive investments. Neither the principal nor the underlying assets of target date portfolios are guaranteed at any time, including the target date. Investment risk remains at all times. Asset allocation and diversification do not ensure a profit or protect against a loss. Be sure to see the relevant prospectus or offering document for full discussion of a target date investment option including determination of when the portfolio achieves its most conservative allocation.

Unless noted otherwise, facts within are based on the following Principal® Future of Retirement, January 2023

Online survey

20-minute survey conducted by Principal

Field dates

October 25 – November 14, 2022

Respondents

255 plan sponsors: 80% SMBs (<500 employees), 20% large businesses (500+ employees) 201 financial professionals with income from: group retirement plans, individual IRAs, individual annuities, individual investments, insurance, and other

Qualifications

Age 18+, U.S. based business, company offers a retirement plan record kept by Principal.

Margin of error

+/- 6.1% for plan sponsors at the 95% confidence level. +/- 6.9% for financial professionals at the 95% confidence level.