How it works

Based on a few inputs from you – such as…

-

Your age

- Retirement goals

- How you feel about investment risk

… our automated investor recommends a diversified investment mix of proprietary mutual funds and ETFs. The application is entirely online and typically takes less than 10 minutes. We’ll start actively managing your investments based on your retirement goals.

Get personalized investment advice

Everyone's financial goals are different. Our proprietary algorithm puts you at the center of the equation.

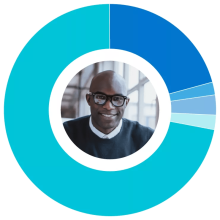

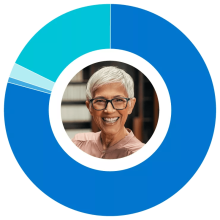

Key for donut charts. Items presented in chart starting at the top and displayed clockwise.

Jordan | 24

Investment model: Risk-based

Retirement age: 63

Goal: Save for retirement

Risk profile: Aggressive

Avery | 41

Investment model: Time-based

Retirement age: 65

Goal: Save for retirement

Risk profile: Balanced

Alex | 60

Investment model: Risk-based

Retirement age: Retired

Goal: Use my retirement savings

Risk profile: Conservative

Note: Portfolio allocations are approximate. Individual portfolio allocations may vary.

Choose an investment model that fits your needs.

Time-based investing

- Diversified mix of investments unique to your needs.

- Automatically adjusts asset allocation (aka your mix of investments) to become more conservative over time.

- Minimizes vulnerability to market volatility as you get closer to achieving your goals.

Risk-based investing

- Diversified mix of investments according to your comfort with risk

- Automatically adjusts asset allocation (aka your mix of investments) to maintain your risk level as markets change.

- Your risk level remains constant until you change it, which you can do at any time by retaking the risk questionnaire.

Sit back and relax with automatic adjustments.

We keep an eye on your account – so when your investment mix needs to be rebalanced, it’s done automatically to help keep you on track.

When your goals change, just update your account and we’ll adjust your investment mix to match. We can do the heavy lifting.

Bonus: Technology and real people.

You’ll have ongoing access to a dedicated team of financial professionals throughout your retirement journey.

They’ll answer questions about your investments and provide guidance on other financial topics life throws your way.

We support you every step of the way.

We help you plan for the future with interactive retirement planning resources, checklists and educational content -- sent right in your inbox. Principal also provides complimentary, ongoing education for your financial needs.

Fees

Total annualized program fee is .85% of your account balance. The Principal® SimpleInvest program fee represents both the account management fee and the investment expenses. 1,2

Ready to get started?

Discover what Principal® SimpleInvest can do for you.

Monday – Friday,

8 a.m. to 5 p.m. CST

1 Please refer to the Principal Advised Services' Form ADV 2A (PDF) for additional information regarding fees and compensation.

2 The account management fee is typically an annualized 0.4% of your account balance. The account management fee is debited from your account monthly and varies based on your investment portfolio. The investment expenses are typically an annualized 0.45% of your account balance and varies based on your investment portfolio. Investment expenses are taken out of the value of your underlying investments, not debited from your account.

| Investment and Insurance products are: • Not Insured by the FDIC or Any Federal Government Agency • Not a Deposit or Other Obligation of, or Guaranteed by, Principal Bank or Any Bank Affiliate • Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested |

Investing involves risk, including possible loss of principal. Asset allocation and diversification do not ensure a profit or protect against a loss.

Principal® SimpleInvest is a discretionary investment advisory program that offers diversified investment portfolios for a fee. Principal® SimpleInvest is sponsored and managed by Principal Advised Services, LLC, which consults with Principal Global Investors, LLC in the creation of the portfolios and the selection of the underlying portfolio investments. Principal Global Investors, LLC also provides trading and execution services. Principal Advised Services, LLC and Principal Global Investors, LLC are members of the Principal Financial Group®. Brokerage and custodial services provided by Apex Clearing Corporation, member FINRA, NYSE and SIPC. Apex Clearing Corporation is not affiliated with any member of the Principal Financial Group®. Principal® SimpleInvest portfolios are comprised primarily of Principal® products, including affiliated mutual funds and ETFs.

Please refer to the Form ADV (PDF) and Form CRS (PDF) for Principal Advised Services, LLC, the Miscellaneous Fee Schedule (PDF) for Apex Clearing Corporation, and other applicable disclosures and agreements for important information about Principal® SimpleInvest and its services, fees and related conflicts of interest. All investments have inherent risks. Investing in Principal® SimpleInvest portfolios does not guarantee profit or protect against loss.